Are you covered for mold damage? Learn all about mold damage insurance in our comprehensive guide. Understand the ins and outs of your policy and how to navigate the process in case mold strikes your home.

Understanding Mold Damage Insurance Coverage

Understanding Mold Damage Insurance Coverage

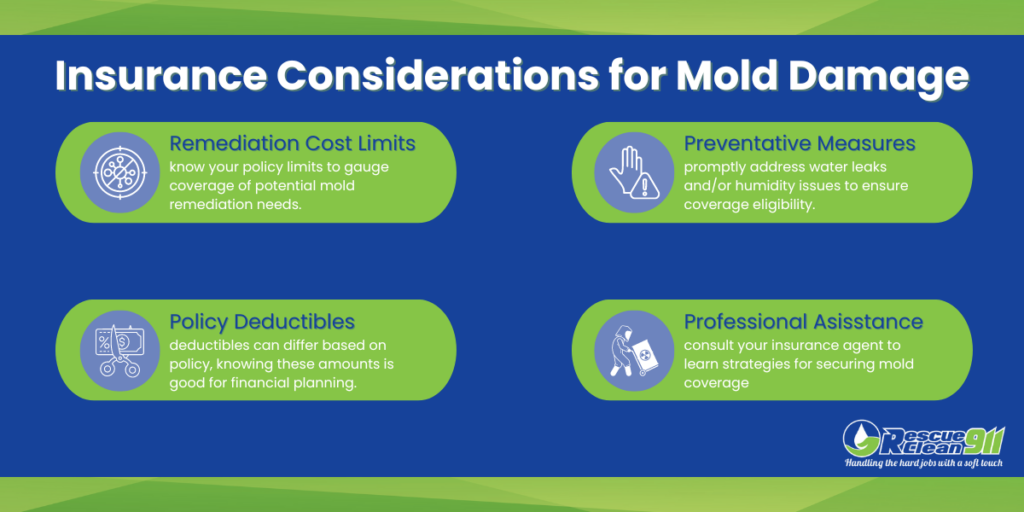

When dealing with mold damage in your home, it’s important to understand your insurance coverage. Most standard homeowners policies do not cover mold damage caused by lack of maintenance or a preventable water leak. However, if the mold growth is a result of a covered peril, such as a sudden pipe burst, your insurance may help cover the cost of remediation.

It’s crucial to review your policy to see what is and isn’t covered when it comes to mold damage. Additionally, consider purchasing a separate mold insurance rider to ensure you have adequate protection. Keep in mind that mold claims can be complex, so working with a certified mold remediation professional and your insurance company can help navigate the process effectively.

Remember, prevention is key when it comes to mold damage. Regular home maintenance and quick action to address any water issues can help reduce the chances of mold growth and potential insurance complications.

Frequently Asked Questions

Will my homeowner’s insurance policy cover mold damage?

Generally, homeowner’s insurance policies do not cover mold damage caused by lack of maintenance or preventable issues. However, if the mold is a result of a covered peril, such as a burst pipe, your insurance policy may provide coverage. It is important to review your policy and speak with your insurance provider to understand specific coverage for mold damage.

What steps should I take to file a mold damage insurance claim?

To file a mold damage insurance claim in the context of Mold Solutions Guide, you should:

- Document the damage with photos and videos

- Contact your insurance company immediately

- Hire a professional mold remediation company to assess and repair the damage

- Keep all receipts and records related to the claim

Are there specific requirements or documentation needed to claim mold damage on insurance?

Yes, there are specific requirements and documentation needed to claim mold damage on insurance, such as proof of the cause of the mold, extent of the damage, and professional remediation reports.

How can I prevent future mold damage to ensure insurance coverage?

To prevent future mold damage and ensure insurance coverage, it is important to address any water leaks or moisture issues promptly, maintain proper ventilation in your home, and conduct regular inspections for mold growth.

What should I do if my insurance claim for mold damage is denied?

If your insurance claim for mold damage is denied, review your policy and consider filing an appeal with additional evidence to support your claim.

In conclusion, understanding the ins and outs of mold damage insurance coverage is crucial for homeowners looking to protect their property and finances. Remember to review your policy carefully and consider any additional coverage options that may be beneficial in safeguarding your home against mold-related issues. By staying informed and proactive, you can better navigate the complexities of mold insurance claims and ensure that your property is adequately protected in the event of a mold infestation.

![]()